Getting My Fortitude Financial Group To Work

Table of ContentsThe 6-Minute Rule for Fortitude Financial GroupEverything about Fortitude Financial GroupOur Fortitude Financial Group StatementsThings about Fortitude Financial GroupHow Fortitude Financial Group can Save You Time, Stress, and Money.

Some experts may offer reduced prices to help customers who are just obtaining started with financial preparation and can not afford a high month-to-month price. Typically, a monetary expert will use a totally free, preliminary examination.A fee-based advisor may gain a cost for developing a financial plan for you, while additionally earning a payment for marketing you a particular insurance coverage item or financial investment. A fee-only financial advisor makes no payments.

Robo-advisors don't need you to have much money to obtain begun, and they set you back much less than human financial advisors. Examples consist of Improvement and Wealthfront. These services can save you time and possibly money as well. A robo-advisor can't talk with you concerning the finest method to obtain out of debt or fund your child's education and learning.

Excitement About Fortitude Financial Group

Robo-advisors usually invest customers' cash in a portfolio of exchange-traded funds (ETFs) and common funds that offer supply and bond direct exposure and track a market index. It's likewise vital to bear in mind that if you have an intricate estate or tax problem, you will likely call for the extremely individualized recommendations that only a human can supply.

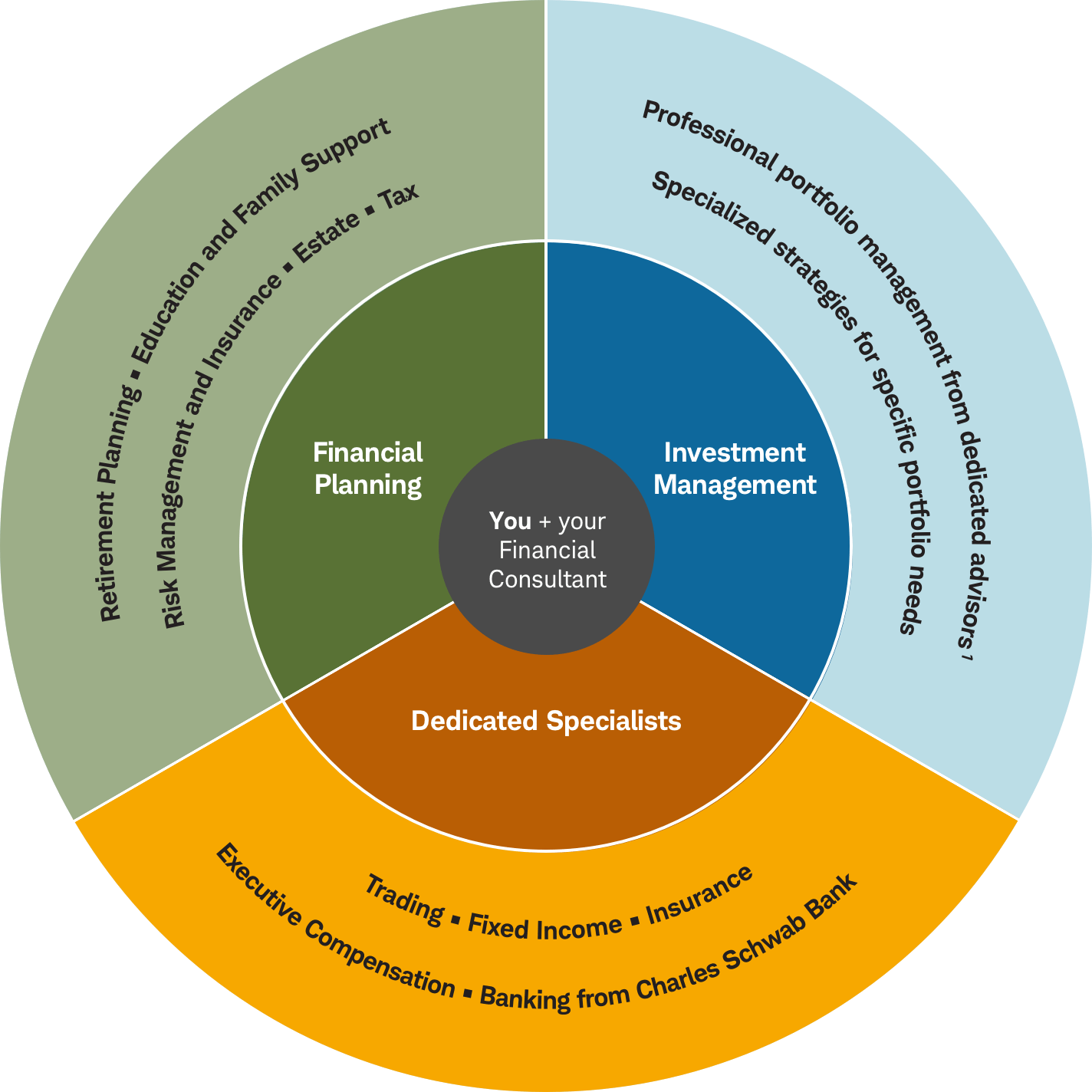

An expert can aid you figure out your financial savings, how to build for retirement, help with estate planning, and others. Financial experts can be paid in a number of ways.

A lot of economic advisors help a portion fee based upon the quantity they are accountable for. Some, like hedge funds, will certainly make a percent of your profit as well. Financial advisors are almost never "complimentary." Although you may not be accountable for any kind of in advance costs, an economic expert can make a percentage of your principal, payments on what items they offer you, and sometimes also a portion of your revenues.

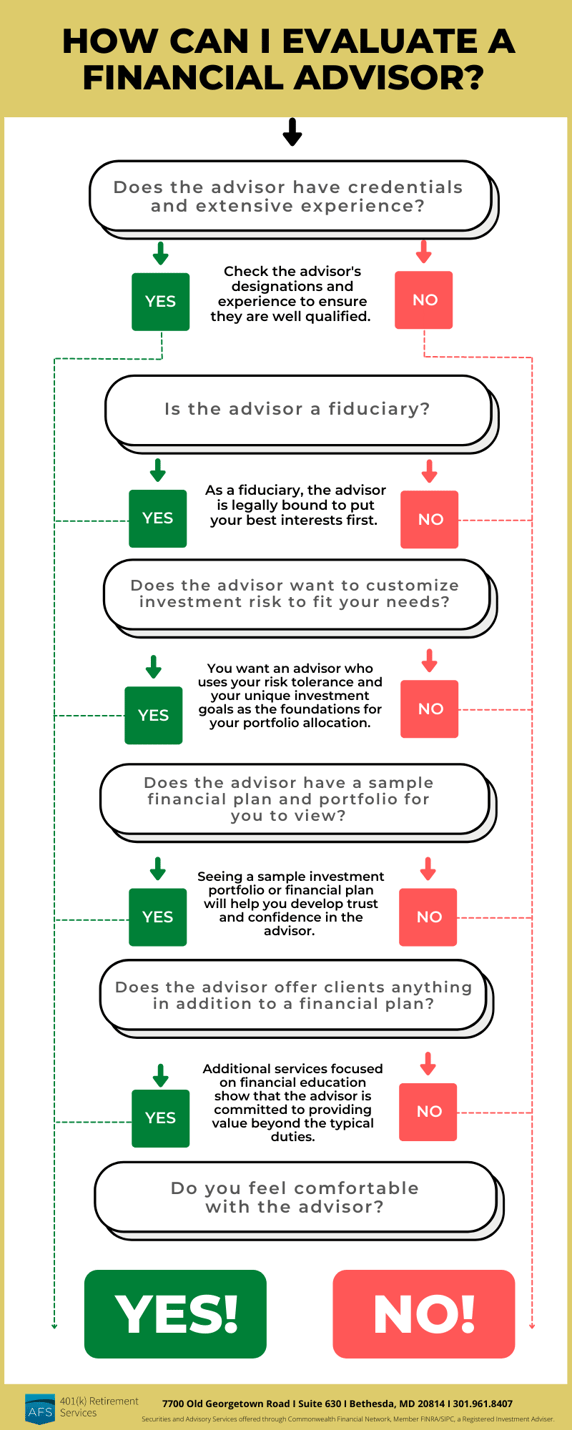

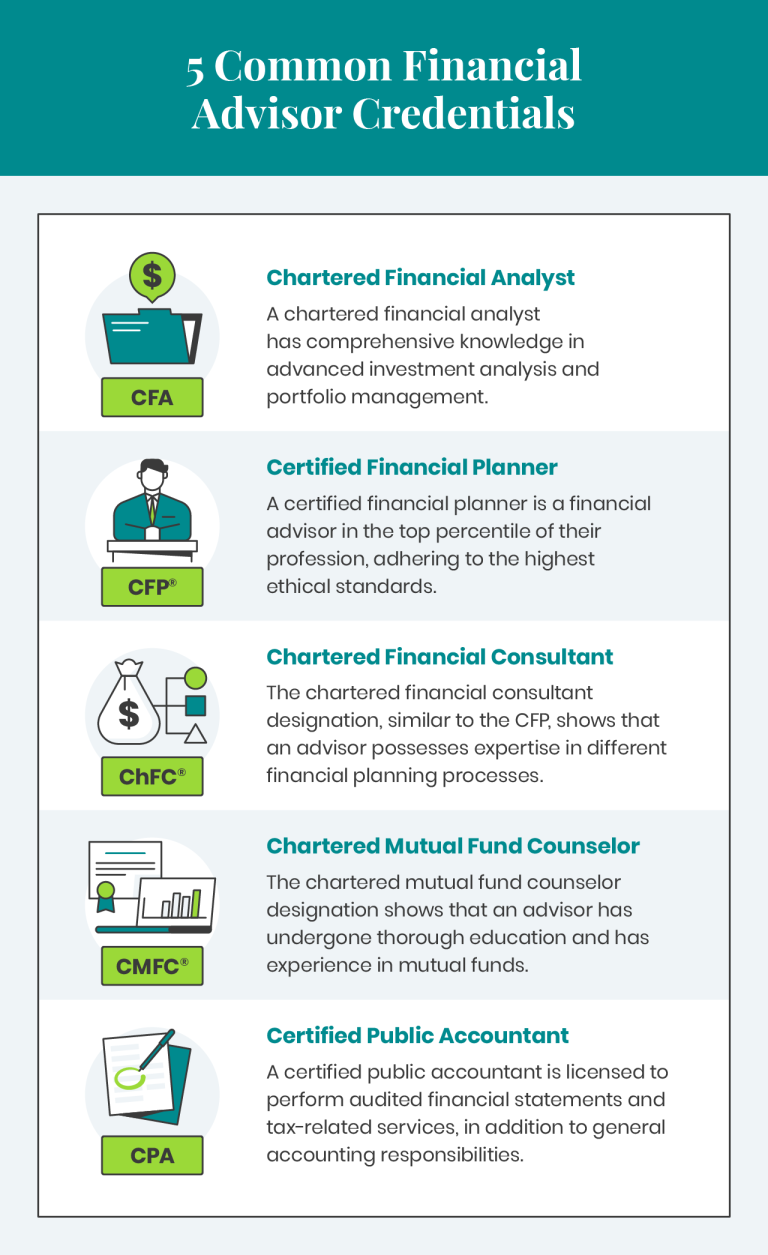

This isn't to state the person making use of the expert is losing anything, yet the expert, and that they function, for will certainly always locate a means to revenue. Not all financial experts have the exact same level of training or will certainly provide you the same deepness of solutions. When getting with an advisor, do your own due diligence to make sure the advisor can meet your financial preparation needs.

The smart Trick of Fortitude Financial Group That Nobody is Discussing

Ramsey Solutions is not associated with any kind of SmartVestor Pros and neither Ramsey Solutions nor any of its agents are licensed to supply financial investment suggestions on behalf of a SmartVestor Pro or to act for or bind a SmartVestor Pro. Each SmartVestor Pro has participated in an agreement with Ramsey Solutions under which the Pro pays Ramsey Solutions a combination of fees.

The existence of these arrangements might affect a SmartVestor Pro's determination to bargain listed below their typical investment advisory fees, and for that reason may affect the overall costs paid by customers introduced by Ramsey Solutions with the SmartVestor program. Please ask your SmartVestor Pro to learn more regarding their charges (St. Petersburg Investment Tax Planning Service). Neither Ramsey Solutions neither its affiliates are participated in giving financial investment guidance

Ramsey Solutions does not call for any type of solutions of any type of SmartVestor Pro and makes no claim or guarantee of any type of result or success of preserving a SmartVestor Pro more - https://myspace.com/fortitudefg1. Your use the SmartVestor program, consisting of the decision to preserve the solutions of any SmartVestor Pro, is at your single discretion and threat

The 6-Second Trick For Fortitude Financial Group

The contact connects offered attach to third-party websites. Ramsey Solutions and its affiliates are not responsible for the precision or reliability of any details included on third-party sites.

No two individuals will have quite the very same set of investment strategies or options. Depending upon your objectives in addition to your tolerance for danger and the time you have to seek those objectives, your expert can aid you recognize a mix of investments that are suitable for you and created to aid you reach them.

An advisor can walk you with numerous complicated monetary options. Suppose you acquire your parents' home? Is it smarter to offer it and spend the profits or lease it out for revenue? As you come close to retired life, you'll be encountered with vital choices concerning how much time to function, when to declare Social Security, what order to withdraw money from your various accounts and how to balance your requirement for earnings with making certain your cash lasts you for the rest of your life.

A person who can help them make sense of it all. "Your consultant is best made use of as a partner that has the experience to aid you navigate the chances and difficulties of your economic life. The economic technique your expert will certainly help you create is like an individual economic roadway map you can follow and adjust to seek your objectives," states Galinskaya.

4 Easy Facts About Fortitude Financial Group Shown